Browse Your Financial Resources with Professional Loan Service Assistance

Wiki Article

Discover Reliable Funding Solutions for All Your Financial Needs

In navigating the huge landscape of economic services, locating trusted funding carriers that provide to your details needs can be a complicated task. Let's discover some crucial aspects to take into consideration when looking for out loan services that are not just trusted yet additionally tailored to fulfill your distinct monetary needs.Kinds Of Personal Lendings

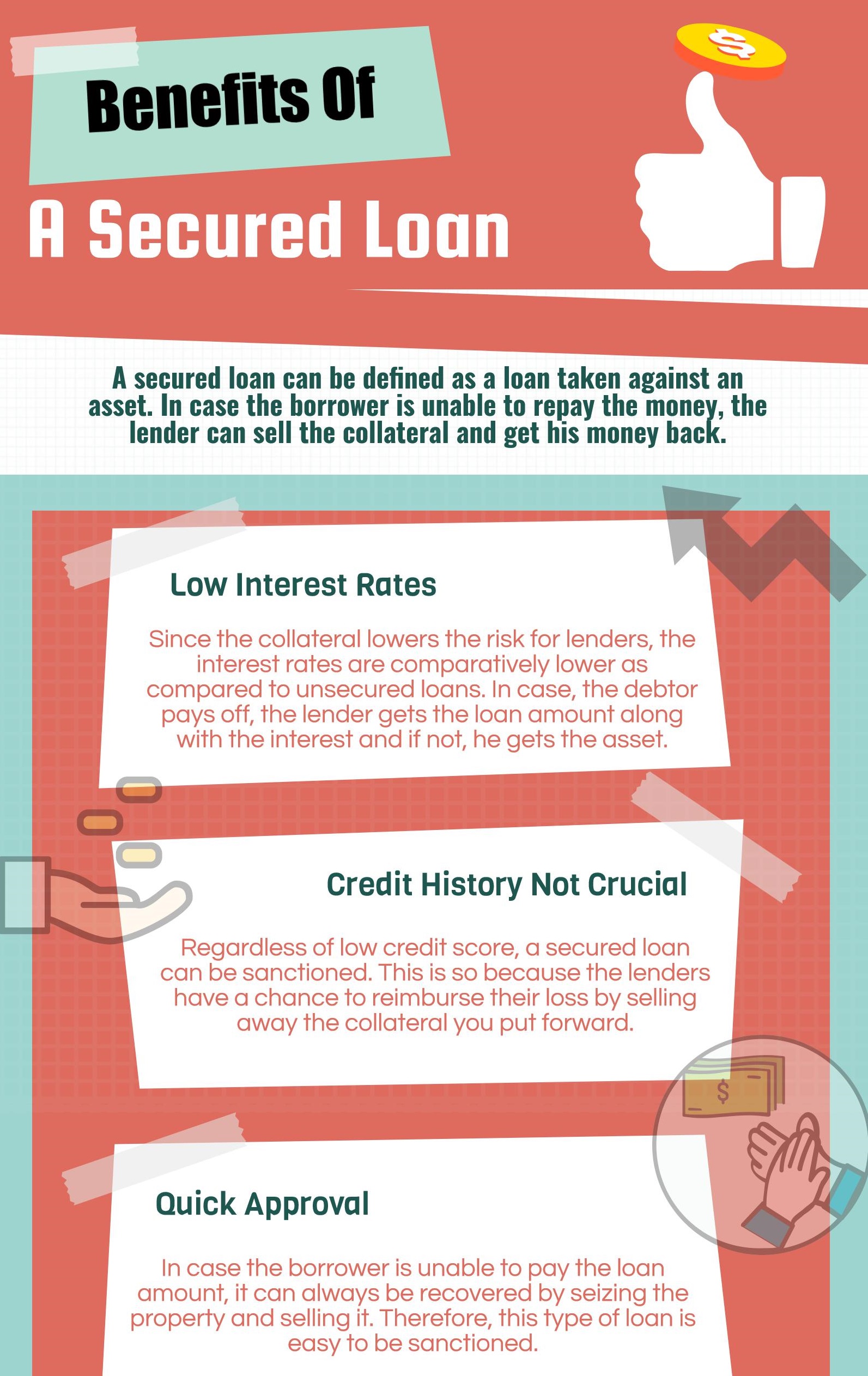

When thinking about individual loans, people can pick from numerous kinds customized to meet their particular monetary needs. One typical type is the unsecured individual finance, which does not need collateral and is based upon the customer's credit reliability. These car loans generally have greater rate of interest as a result of the enhanced risk for the lending institution. On the other hand, protected individual financings are backed by collateral, such as a car or interest-bearing accounts, causing lower rate of interest as the loan provider has a form of protection. For individuals looking to consolidate high-interest debts, a debt combination car loan is a viable alternative. This type of funding incorporates several debts into a single month-to-month settlement, usually with a reduced rates of interest. Furthermore, people looking for funds for home renovations or significant purchases may choose for a home improvement financing. These financings are particularly developed to cover expenditures associated to boosting one's home and can be secured or unprotected depending on the lender's terms.Advantages of Online Lenders

Comprehending Credit Rating Union Options

Checking out the diverse range of cooperative credit union choices can provide people with an important choice when seeking monetary solutions. Cooperative credit union are not-for-profit monetary cooperatives that offer a variety of items and solutions similar to those of banks, consisting of financial savings and checking accounts, car loans, charge card, and more. One essential distinction is that credit unions are possessed and operated by their members, that are additionally clients of the establishment. This ownership framework typically equates into lower fees, affordable rate of interest on fundings and interest-bearing accounts, and a strong emphasis on customer support.Cooperative credit union can be attracting individuals searching for a more personalized approach to financial, as they generally focus on member complete satisfaction over revenues. Furthermore, cooperative credit union often have a solid area presence and might use financial education sources to help participants boost their monetary proficiency. By understanding the choices readily available at cooperative credit union, people can make educated choices about where to entrust their monetary needs.

Exploring Peer-to-Peer Loaning

One of the crucial destinations of peer-to-peer loaning is the capacity for reduced interest prices contrasted to standard economic organizations, making it an attractive alternative for customers. Furthermore, the application procedure for acquiring a peer-to-peer car loan is usually streamlined and can result in faster access to funds.Capitalists also take advantage of peer-to-peer loaning by possibly gaining greater returns contrasted to standard investment options. By removing the middleman, financiers can straight same day merchant cash advance fund consumers and receive a part of the passion settlements. However, it is very important to note that like any financial investment, peer-to-peer loaning brings integral threats, such as the opportunity of customers back-pedaling their fundings.

Entitlement Program Programs

Amidst the evolving landscape of financial solutions, an essential aspect to think about is the world of Federal government Assistance Programs. These programs play an important duty in providing financial assistance and support to individuals and services throughout times of need. From welfare to bank loan, entitlement program programs aim to ease financial concerns and promote financial stability.One prominent example of an entitlement program program is the Small company Administration (SBA) financings. These financings supply beneficial terms and low-interest rates to assist little services expand and browse challenges - best mca lenders. Additionally, programs like the Supplemental Nutrition Aid Program (SNAP) and Temporary Support for Needy Households (TANF) provide important assistance for individuals and family members facing economic challenge

Additionally, entitlement program programs expand past financial assistance, including real estate aid, health care aids, and educational gives. These campaigns intend to attend to systemic inequalities, advertise social welfare, and make certain that all citizens have access to fundamental requirements and opportunities for advancement. By leveraging entitlement program programs, individuals and organizations can weather economic storms and aim towards an extra safe financial future.

Final Thought

Report this wiki page